When I first was introduced to the points world I was very skeptical of the claims that people were making. Somehow people were getting thousands of frequent flier miles and hotel points by never setting foot in a plane or hotel.

I didn’t quite understand how they were doing that because I thought the only way to get frequent flier miles were to you know, fly. Thinking that they were part of some scam I didn’t pay too much attention until I started reading through the forums on FlyerTalk.

I began to start understanding many of the methods that people use to get thousands of points by using credit card sign up bonuses.

After learning the ins and outs I tossed my hat into the ring and started trying it out myself. In the few years that it has been since I first started collecting points I can say that I’ve just crossed the 1,000,000 point mark in my miles collection.

With those points I’ve been able to travel to Europe twice (flying in first class), Utah, Caribbean, Hawaii, California and of course Disney many times.

I want to share all of the methods that I have learned over the past few years with all of you so you too can fly and stay for free on your Disney vacations. Airline miles and hotel points are going to be our currencies of choice which I will go into with this post.

The purpose of this post is to give you a high level understanding of how the points game works, there will be many more follow up posts that go in depth on how to redeem your points for free travel.

Let’s get started on your path to free travel!

What Are These Points/Miles?

Let’s start at the very beginning of the whole points game – what exactly are they? Generally there are three different types of points that we will be referring to here at Frugal Mouse:

Frequent Flier Miles

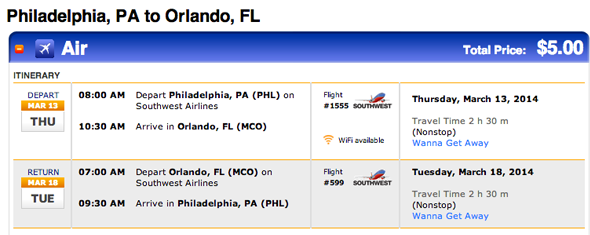

These are issued by all of the major airlines to help keep customers using their airlines for all of their travel. For every mile flown you earn one frequent flier mile. For example Philadelphia to Orlando is approximately 1,000 miles so I could earn 2,000 frequent flier miles for a round trip.

After that first trip I have a nice 2,000 mile balance in my account, perhaps I should stick with the same airline for my next trip so I can keep working towards a free flight.

After you earn enough of these frequent flier miles you can use them to redeem for a free flight, usually around 25,000 points for a round trip ticket anywhere in the US. Not a bad deal right?

One a very basic level that’s how frequent flier miles work, to help keep fliers loyal to an airline by awarding them for travel on them.

Hotel Points

Hotels began to see that people were staying loyal to airlines through their frequent flier programs so how could hotels do something similar? That was the birth of the hotel points system that most major hotel chains have in place today.

Instead of earning frequent filer miles by flying, you earn hotel points based on the cost of the rooms you stay in.

For example if you stay 4 nights at a hotel at $100 a night, you would earn about 400 hotel points for that stay. Similar to the airline programs, once you accrue enough hotel points you can then redeem them for free nights at their hotels.

Credit Card Issuer Points

A relative new player in the game of points are the flexible points that are offered by the major credit card issuers (American Express, Chase, Citi). Credit card companies make money by you spending money on their credit cards – they get a cut of the processing fees for each transaction you make.

The credit card companies said to themselves, how do we encourage people to spend on our cards? Points!

When you spend on these special credit cards you earn a point per dollar spent. Some cards offer bonus points for certain spent categories such as 2x points for dining or 5x points spent at gas stations.

The credit card points are some of the most valuable point currencies out there for one reason – flexibility.

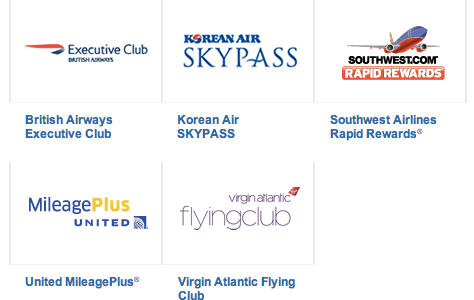

Ultimate Rewards points from Chase and Membership Rewards points from American Express transfer out to many airline frequent flier programs and hotel point programs making them very valuable for that reason.

Points earned through the credit card companies are among the most valuable out there which is why we will try to get a lot of them.

Now that you have a good primer on how points work – let’s get started on how to start earning them.

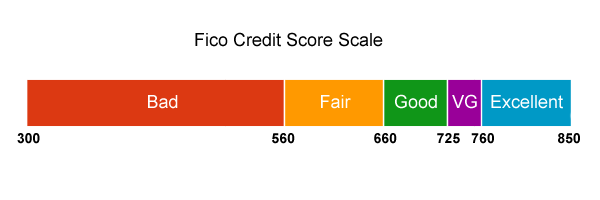

Step 1: Credit Check

The key to being able to get credit card sign up bonuses is having good credit which will allow you to get the sign up point bonuses. Be sure to review the credit score page to find out free ways to check up on your credit.

Once you have your credit score of 700+ ready to go you’re set to move onto step 2.

Step 2: Sign up for Points Programs

Each airline and hotel chain and credit card issuer has their own program that we’ll use to keep our points in, they are all free to enroll. You’ll see three different types of point types in the list below – airline, hotel and credit card.

Credit card points such as Ultimate Rewards from Chase are flexible (and valuable) points that allow you to transfer out to many different airline and hotel programs.

I would recommend signing up for the programs below:

Airline Frequent Flier Programs

- US Airways – Dividend Miles

- United – Mileage Plus

- American Airlines – AAdvantage

- Southwest – Rapid Rewards

- Delta – Skymiles

Hotel Loyalty Programs

- Starwood – Starwood Preferred Guest

- Hilton – HHonors

- Mariott – Mariott Rewards

- Carlson – Club Carlson

- InternContinental Hotels Group – IGH Rewards

Credit Card Programs – You don’t need to apply for these, you will be given an account after you sign up for one of the cards from these programs

- Chase – Ultimate Rewards

- American Express – Membership Rewards

- Citi – Thank You

Now that you have 10+ point accounts open, there is a great site from AwardWallet which allows you to keep track of all you points in one place. I highly recommend signing up for AwardWallet and storing all of your accounts.

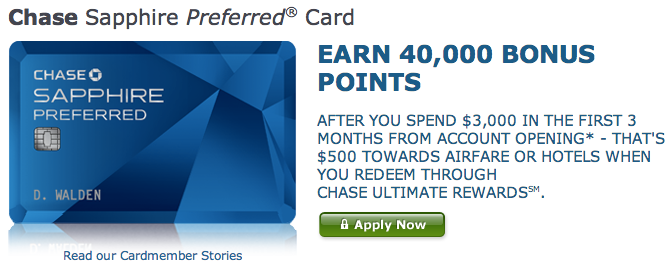

Step 4: Plan for Credit Card Applications

Now we are all set to start our first round of credit card applications. The way we are going to get our points without ever setting foot in an airplane or hotel room is through credit card sign up bonuses. Many different banks offer credit cards branded for each airline and hotel. Important: You must pay off the full amount on your cards each month to avoid interest charges. We don’t want our spending to cost us money which means we need to pay in full each month. It is key that you do not get into credit card debt or be hit with late fees or interest or you’ll end up paying a lot for these points.

Each credit card we sign up for will have a few parts:

- Annual Fee: There will be some cards that have annual fees but many are waived for the first year. We’ll focus on cards that waive that fee for the first year.

- Spend Requirement: Most cards will have some type of spend requirement in order to earn the sign up bonus. A card may say for example, spend $3000 in the first 3 months to earn 50,000 points.

- Award: After hitting the spend requirement you’ll be awarded points which will deposit into your accounts. Some cards award free nights or cash back as well after hitting spend requirements.

We need to follow a schedule for our credit card applications you don’t get declined due to “too many applications”. My rule of thumb is to do a round of applications every 90 days with no more than one card for each major issuer (Citi, Chase, Barclays, Bank of American, Amex).

I have never been declined due to too many applications by following this schedule. Each credit card has spend bonus which means you must spend a certain amount of money on a card to be awarded with the point bonus.

The required spend bonuses will be clear during the sign ups, many are in the $3,000 range within the first 90 days to get the bonuses. The spend requirements are very important for choosing credit cards for the sign up bonuses because you’ll need to make sure you can hit those spend requirements within the time required.

If you miss the spend amounts by even 1 day you won’t get the bonus points. If you can only hit the spend requirement of one card at a time – no problem, it’s better to have less cards to make sure you hit the spend to get the points.

Step 4: Apply!

Now that we have all of our pre-work out of the way it’s time to start our applications! Review the Best Credit Card offers page to see what the best current cards there are out there currently. I’ll be sure to keep that page updated with the best offers available. When applying be sure to be truthful and accurate with your information – if all goes well you’ll be instantly approved! You may get a message that they need some time to process or review your application. Usually that just means that a piece of information you entered was flagged and needs to be reviewed by a person.

You’ll Be Racking Up The Points Soon!

The best course of action is to pick up the phone and dial the re-consideration line for the credit card issuer.

- American Express: 866-314-0237

- Chase: 888-245-0625

- Bank Of America: 866-530-9829

- Barclay’s: 866-408-4064 connects directly to a credit analyst

- Citibank: 800-695-5171

- US Bank: 800-947-1444

Step 5: Hit Spend Requirements

Congratulations on being approved for your card – now it’s time to get down to work and start spending. At the end of the day you just need to make sure you spend the required amount within the time required to be awarded the points. I personally put every single dime of my spending on my credit cards and then pay them off in full each month. Here are a few strategies to hit the spend requirements:

- Car payments

- Mortgage

- Groceries

- Bills – Cell Phone, cable/internet, electricity, gas, water

- Dining out

- Tuition/books

- Disney gift cards – you can purchase gift cards on your credit card then use the gift cards in the park.

- Gas

- Insurance

There are many other ways you can hit spend requirements, I’ll have a full post with more detail along with some other strategies soon! That should do it for our Points 101 course today. It may seem like a lot of work at first glance but once you get into the swing of how this process works you’ll find that it will be much easier the more you do it. The major takeaways from this post are:

- You need to have good credit to take advantage of the credit card sign up bonuses

- Pay in full your credit card bills each month

- Make sure you can hit the spend requirements

- Get those points and use them for free travel to Disney!

If you have any questions about anything in this post, ask your question in the comments or send a question through the contact Frugal Mouse page.

You mentioned that a person can pay their mortgage with their rewards card. How does this work? Thanks!

Hi Benjamin – The way I’m currently paying my mortgage is through the use of Amazon payments (https://payments.amazon.com/home). Amazon Payments allows you to send up to $1,000 with no fees to another person each month using a credit card. I transfer the money to my friend using Amazon Payments using my point earning credit card then he transfers it back to me using my back account person to person payment.

Now I can use that $1,000 to pay for my mortgage each month! There used to be another way using Vanilla Reload cards and an Amex Bluebird account but that method doesn’t really work anymore.

Hi frugal mouse

So i m new to the points game. Just applied and got amex platinum and amex platinum business with a combined 140k miles. So after hitting the spending requirement should i cancel these cards and apply again in a year? or how long is the time we should wait for the next round of applying for the same cards (amex, capital one etc) ?

thanks love your website

Hi Brownbear! The Amex Platimum is a excellent card with many great perks such as the $200 airline reimbursement, SPG Gold Status and lounge access. The only downside is the expensive annual fee so with that I would definitely only pay that one time.

Amex has been cracking down a card churning so there is a good chance that even if you wait a year after applying that you won’t get the sign up bonus again. I would look at many of the other cards from Amex, Chase, Citi and Barclays. One of my favorite cards, the SPG Amex just increased the sign up offer to 30k points which I wrote about here: http://www.frugalmouse.com/starwood-preferred-guest-30000-point-offer-back/

During your next churning round I would get 1 card from each major bank, that way you diversify you points and are guaranteed the sign up bonuses because you didn’t get them before.

you might want to recheck your airline miles as some companies have started paying points for amount of ticket not miles.

Thanks Mel – Yes you are correct I’ll be updating this page to reflect the revenue based systems that Delta and United are moving towards. Luckily it won’t impact earning through credit cards too much (yet) but for frequent fliers is a huge negative change.

Is there updates to the above information.? one of the concerns I have is . dropping a card or cards each year and reapplying does effect your credit Iam being told.

Hi Karin – Opening new lines of credit can lower your score by 2-3 points temporarily because a hard inquiry is made on your credit report. BUT – that slight drop is offset by a 3-5 point increase because your credit utilization goes up when you’re approved for a new card. Basically the net is none or a very little change in your credit score.

Right now my credit score is 770 and I’ve been churning cards for years.

Are you able to still send money to a friend through Amazon Payments?

No, unfortunately they stopped the ability to send money to friends using credit cards. 🙁

Have you found a new way to pay your mortgage with a credit card?

Some mortgage companies allow you to pay with credit cards but as of now there is no easy way to do it except for some services which charge high fees.